Bussiness

April 2024 US employment report: Cooling, but still tight

The April US employment report pointed to a cooler labour market than expected, with headline payrolls growth sub-expectations, and unemployment ticking higher, as earnings pressures continued to ease.

Nevertheless, this cooling is by no means extreme and, despite a dovish market reaction to the data, shan’t elicit any form of policy response for now.

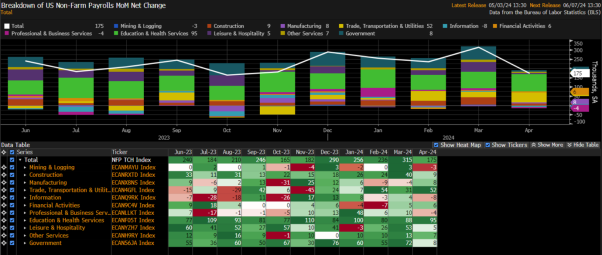

Headline nonfarm payrolls rose by 175k in April, marginally below consensus expectations for a +240k rise, though well within the always-wide forecast range, of +145k to +280k.

Furthermore, the February and March payrolls prints were revised by a net -22k, seeing the 3-month average of job gains dip to 242k, roughly in line with the breakeven payrolls rate required for job gains to keep pace with growth in the labour force.

Digging into the payrolls print, the sectoral split shows a mixed picture. Once again, education and health contributed the biggest monthly job gain, while monthly employment declines were seen in the mining & logging, information, and professional and business services sectors.

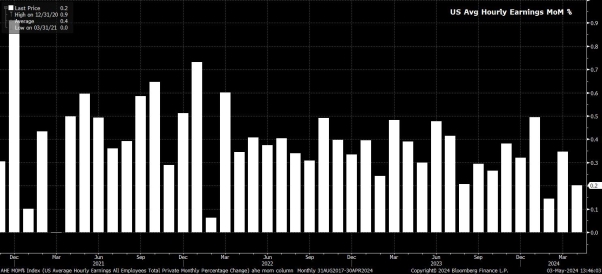

Sticking with the establishment survey, the employment report showed average hourly earnings rose by 0.2% MoM in April, again a touch cooler than consensus expectations for the figure to remain unchanged from the 0.3% MoM pace seen a month prior.

On an annual basis, earnings rose by 3.9% YoY, down from 4.1% YoY in March, continuing to represent a modest pace of real earnings growth relatively consistent with the Fed’s 2% inflation target. This slowing in annual earnings growth is a function of both the cooler MoM rise, as well as tougher comps from 2023 increasingly influencing the data. These earnings figures came amid a marginal drop in average hours worked, to 34.3, from 34.4 prior.

Meanwhile, turning to the household survey, data showed headline unemployment at 3.9% last month, a touch above expectations for joblessness to have remained at 3.8%.

Despite the miss, this, and other measures of slack all pointed to the labour market remaining relatively tight. Participation remained at 62.7% in the month, while underemployment ticked just slightly higher to 7.4%, from 7.3% prior.

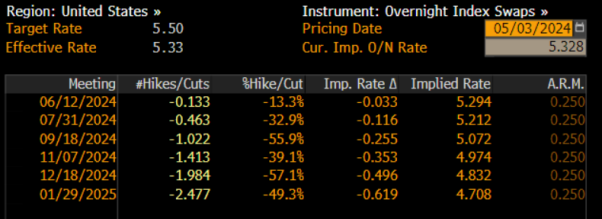

Nevertheless, with the data being softer than expected, markets did dovishly reprice expectations for the Fed policy outlook; however, a significant portion of this repricing likely owed to the overly-hawkish nature of pricing prior to the payrolls number, resulting in positions being unwound as the data dropped.

In any case, the USD OIS curve now prices just over 50bp of easing this year – i.e., 2 cuts – compared to around 43bp prior to the payrolls print, with the curve also now fully discounting the first 25bp cut by the September FOMC meeting, from November previously.

While this pricing does seem more in line with the outlook Chair Powell provided on Wednesday, it is important to note that Powell also remarked how “a couple of tenths” of an increase in unemployment, on its own, would not justify a rate cut, or stand as an ‘unexpected’ weakening in labour conditions.

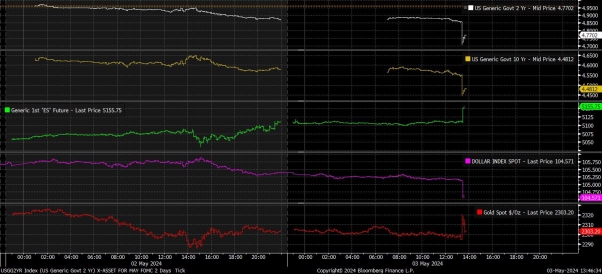

Despite this, the aftermath of the payrolls print saw a dovish reaction across the board.

Treasuries rallied hard, led by the front-end of the curve, with 2s dropping as much as 15bp on the day, before paring losses. This, in turn, posed stiff headwinds for the greenback, taking the DXY back below the 105 figure, and USD/JPY back under the 152 handle – the latter, of course, being good news for the Japanese Ministry of Finance, and their battle to quash JPY weakness.

Lower yields also proved a fillip for gold, with the yellow metal reclaiming $2,300/oz, while stocks popped higher across the board, as the front S&P and Nasdaq futures jumped over 1% on the print.

While the knee-jerk market reaction, and interpretation, of the April jobs report was a dovish one, the data does not appear likely to be a game-changer in terms of the policy outlook. Progress on inflation remains the key determinant of when the first Fed cut will be delivered, hence the next CPI print on 15th May is now the most significant upcoming risk event for markets to navigate.

That said, the jobs report does perhaps hint at the first signs of the labour market beginning to cool, albeit not to anywhere near enough of a degree to warrant a policy response at this moment in time.

Overall, the next move in the fed funds rate remains likely, if not all-but-certain, to be a rate cut, with the FOMC clearly keen on reducing restrictiveness as soon as feasible. This means that the policy backdrop should remain supportive of risk assets, with the ‘Fed Put’ still likely to provide ample confidence for investors to continue to move out the risk curve.

Meanwhile, for the dollar, further broad-based gains now appear unlikely, with the market comfortable with the idea of 1-2 cuts this year, leaving a high bar for further USD appreciation in the near-term.