Bussiness

Macro trader: Fed pricing now sits where it should

After April’s CPI report, Fed pricing seems about where it ‘should’ be, ahead of the June FOMC in a little under a month’s time.

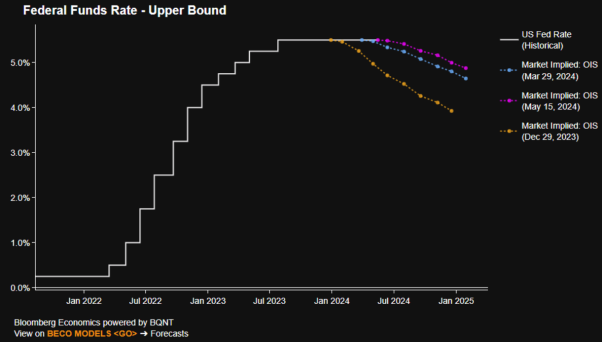

The USD OIS curve, for instance, now prices – as near as makes no difference – 50bp of cuts this year, seeing those moves in September, and December. Individually, a cut at each of those meetings is around a 95% chance, however that is, at this stage, effectively the market fully pricing such an outcome.

Of course, this is still a significantly more hawkish outlook than markets had priced through much of Q1, with money markets having come into 2024 discounting as many as six 25bp cuts, and having ended the first quarter pricing around 85bp of easing.

However, as mentioned numerous times in these pages, that doesn’t especially matter for risk. Instead, what matters is that the Fed have both the ability, and the will to cut rates, and that the next move in the Fed funds rate will be a cut. April’s easing in inflationary pressures, particularly the YoY core CPI measure falling to a near 3-year low 3.6%, only reinforces that view.

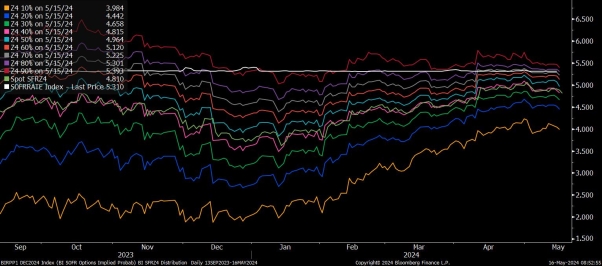

A look at SOFR options helps to evidence this point.

Derivatives now see just a 3% chance that the FOMC deliver another hike by the end of the year, and much of that pricing can likely be put down to hedging flows, as opposed to outright bets on policymakers moving to a tighter stance.

Chair Powell’s assertion at the May FOMC press conference that the next move is “unlikely” to be a hike, coupled with both more promising inflation data, and easing activity figures (cooler April retail sales, GDP growth slipping back under 2% annl. QoQ in Q1), have helped to kill the idea of another hike stone dead – further supporting risk in the process.

Back to the earlier point, though, in that Fed pricing now feels ‘fair’.

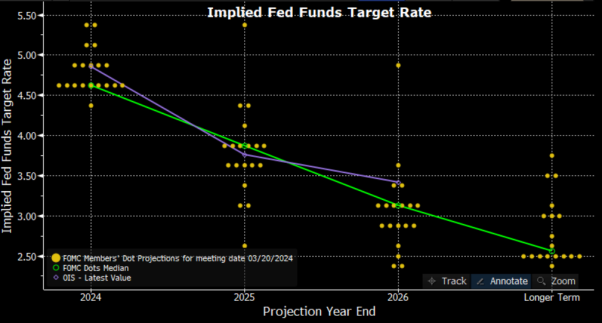

The latest FOMC ‘dot plot’, issued in March, pointed to a median expectation that the fed funds rate would end the year in a range of 4.50% – 4.75%, i.e. 75bp of cuts this year. While such a pace of easing remains possible, particularly in the event of a rapid and unexpected deterioration in labour market conditions, a hawkish revision to the dots seems likely upon the release of the next SEP in June.

Most likely, the updated dots will point to a median expectation for just 50bp of cuts this year. Recent rhetoric from most Fed speakers has signalled a desire to allow policy more time to work, thus delaying the timing of the first cut, while also reducing the cumulative amount of easing that can be delivered this year, without having to cut aggressively. Furthermore, one must recall that it would only take one Committee member currently pencilling in a 4.625% end-24 fed funds rate to revise their estimate 25bp higher to move the median ‘dot’ higher by the same magnitude.

Such a revision to the dot plot, which seems all-but-certain at this stage, would mean that, in something of a rarity compared to the rest of the year, markets and the FOMC would be on the same page when it comes to the policy outlook.

As a result, at least at the front-end of the curve, a neutral stance seems more appropriate for now, albeit the long-end may continue to experience some selling pressure, as markets continue to adjust to the FOMC seemingly targeting an inflation range with 2% as the floor, rather than 2% outright, and as the neutral rate moves higher.

Of course, the side-effect of this is that FX & FI volatility is likely to be somewhat reduced, particularly over the short-term, with the calendar lacking significant macro catalysts until the April PCE report next Friday (which can be easily forecast from the already-released PPI & CPI data), and the May jobs report beyond that on 7th June.

With that in mind, and with the G10 easing cycle set to remain relatively synchronised in nature, the greenback looks set to remain relatively rangebound over the medium term; 104 – 106.50 seems a reasonable band in which to expect the DXY to trade for now.