Bussiness

Time to get hands on this small-cap copper gem

It has been an exceptional year for copper prices, with LME prices breaking above $10,000/t for the first time since 2022. Prices have risen as a result of tightening mine supplies globally and a rise in green energy demand.

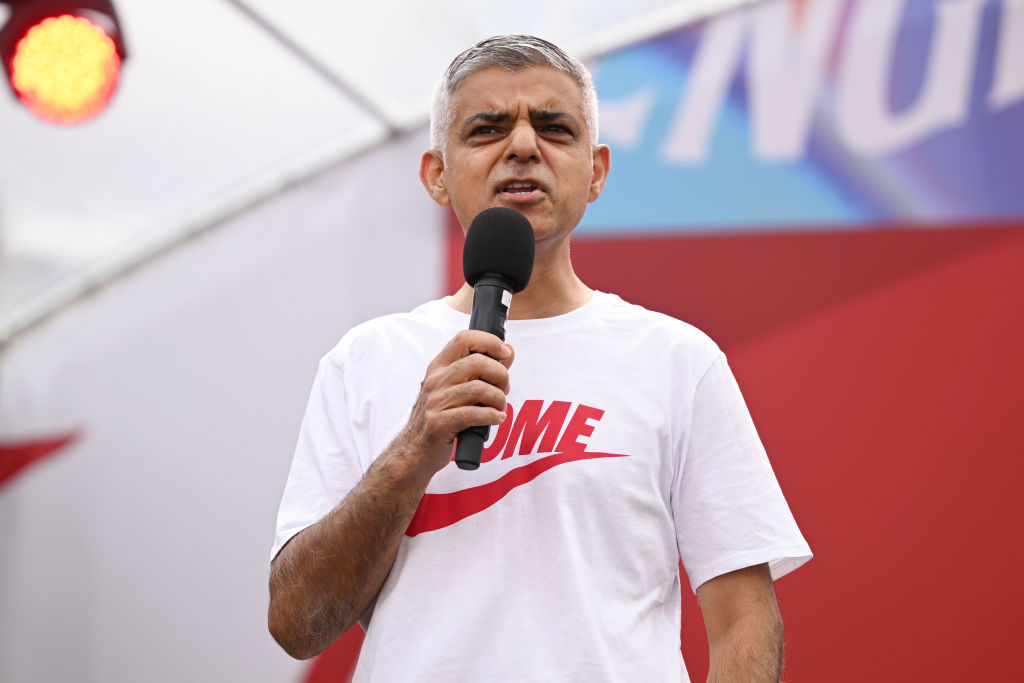

Amidst this boom, Saqib Iqbal, a financial analyst at Trading.biz, thinks now is the right time to invest in small-cap copper mining stocks. One such stock is Metals Acquisition Ltd. (NYSE: MTAL).

- Metals Acquisition Ltd. (NYSE: MTAL) is a small-cap copper mining stock poised for growth amid the copper price boom.

- Recent reserve updates show a significant 64% increase in contained copper.

- Insider transactions suggest confidence in MTAL’s prospects.

He says, “As we transition to a net zero energy future, copper is the new oil. Trading below $15, Metals Acquisition Ltd. (NYSE: MTAL) is a hidden gem waiting to be explored. What I really like is that the recent reserve updates showed an increase of 64% in contained copper. Stock prices are likely to rise based on the company’s ability to economically mine reserves, as well as the potential for further expansion.

Metals Acquisition reported $467 million in underground capital development in its most recent quarterly report, reflecting a focus on the revised mineral reserve plan and greater rehabilitation meters throughout the quarter.

The company has also been drilling since purchasing the CSA Copper Mine in June 2023, with the goal of expanding its high-quality reserves to support a revised resource estimate and mining plan.

If we take a look at insider transactions, Non-Employee Director Graham Van’t Hoff recently purchased $250k worth of stock at a price of $12.45 per share. Another possible sign is that the stock may rise.

But why the small-cap?

The small-cap copper sector is projected to see the greatest percentage increases, with share values rising almost overnight as drills zero in on high-grade copper intercepts.

So, Saqib thinks that, with the current valuations, the stock has a potential for 16% upside.